The UK property market changes a lot because of many factors. For anyone looking at real estate investment in the UK, knowing the price per square metre is key. Location greatly affects property prices, especially in London. For example, South Kensington’s median property prices hit £21,430 per square metre. On streets like Walton Street and Cadogan Gardens, prices reach £16,190 and £24,158 per square metre.

In contrast, places like Bath are more affordable, with median prices at £5,890 per square metre. By May 2024, the average house price in England value per square meter real estate was £302,393. Wales, Scotland, and Northern Ireland had lower prices, with values at £216,002, £191,435, and £178,499. London’s property values have increased by 74% since 2007, despite a recent 2.4% yearly drop in July 2023.

In Greater London, house prices range vastly, from £12,978 to £46,550 per square metre for small spaces. Cambridge also has high property prices at £15,994 per square foot for similar spaces. Meanwhile, Sunderland, Dundee, and Hull offer more budget-friendly options, with prices between £4,163 and £4,839 per square metre.

Recently, detached and semi-detached homes slightly increased in value by 0.5% and 0.7%. However, terraced and flat properties saw a small decrease of 1.0% each. Experts from Savills and Knight Frank predict a decrease in house prices by 10% to 5% by 2023. They anticipate a recovery by 2026, with expected annual growth rates between 1.7% to 3.5% by 2027. This gives a full picture of the UK’s real estate investment scene.

Data from Rightmove, Zoopla, and SpareRoom, along with thorough analysis, offers detailed insights into the UK property market. By looking at the cost per square metre, investors can make smart choices. This ensures they get the best returns on their real estate investments.

Introduction to UK Property Prices

UK property prices change a lot due to different factors. This includes the recent economic downturn and rising mortgage rates, leading to lower property prices. Knowing these trends is key for investors and those wanting to buy a home.

In London, building a three-bedroom cost per square meter house costs between £2,714 to £3,287 per square meter. But in the North of England, it’s cheaper, with prices from £2,182 to £2,684 per square meter. This shows how property costs vary across the country.

Building a new house also varies by region. For example, it costs £327,058 in London but £272,496 in North England. These differences affect the overall property market.

Over the past five years, average asking prices for houses in England and Wales have gone up by 19%. Now, the price per square meter is £2,954. West London’s ‘W’ postcode is the most expensive at £10,427 per square meter, while Sunderland is the cheapest at £1,417.

The cost of building extensions differs too. In East Anglia, it ranges from £2,491 to £3,024 per square meter. In Scotland, the costs are similar, from £2,488 to £2,940. This highlights regional price differences.

Labor costs also play a big part in construction expenses. For instance, builders in Kingston upon Thames charge about £29,975 for a 25-square-meter extension. In Birmingham, it’s much less at £17,972. Local economic conditions and labor markets largely influence these prices.

Location is crucial in the UK property market. For example, the East Midlands has an average asking price of £2,291 per square meter. Greater London is much higher at £6,219. Understanding these details is essential for anyone looking to invest or buy a house.

Knowing these trends helps investors and homebuyers make better decisions. It’s important to look at property price insights, regional differences, and market trends. This guide is a good starting point for understanding the UK property market.

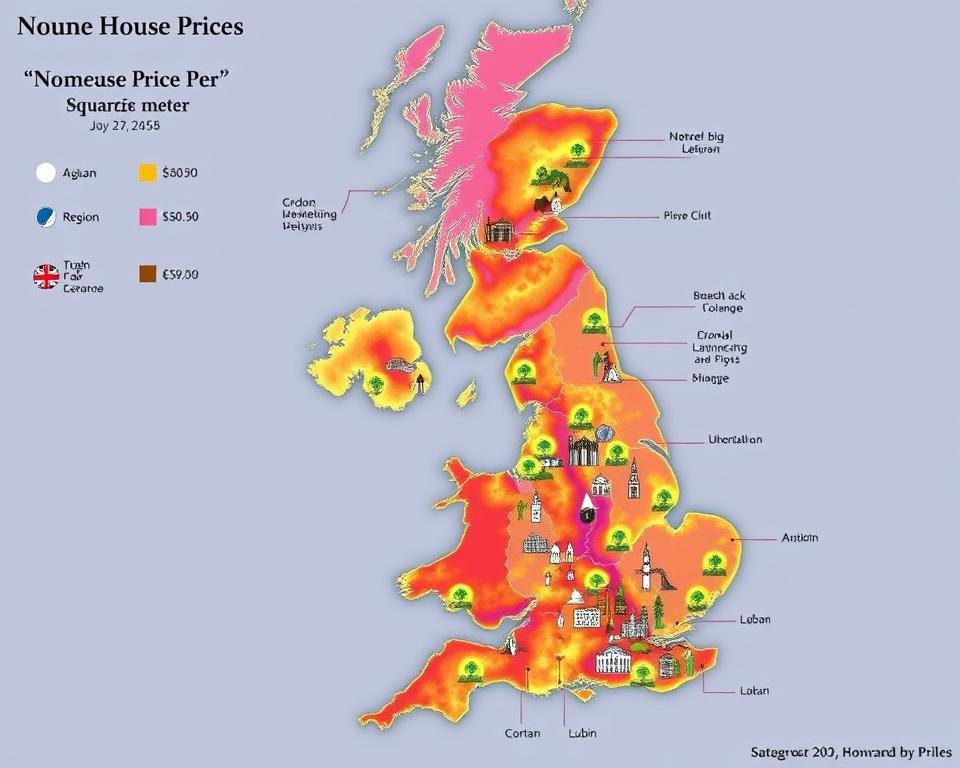

Regional Variations in House Prices per Square Meter

Exploring how house prices price per square meter vary across the UK, we find big differences. In areas like Kensington and Chelsea, the average price can be as high as £19,439 per square meter. But in Blaenau Gwent, South Wales, it drops to just £777 per square meter. This shows the wide range in property values across regions.

In London, prices differ vastly too. Barking and Dagenham offer more affordable housing at £3,994 per square meter, unlike Kensington and Chelsea. Elmbridge in Surrey stands out outside London, with particularly high values compared to other UK regions.

Places like Hackney in London have experienced price surges of 753% since 1997, reaching £6,942. Across the UK, the average is about £2,260 per square meter. London’s property prices have increased by 402% in the last two decades, overshadowing the national growth of 236%.

Yet, in areas like South Wales, homes are much more affordable. Blaenau Gwent and Merthyr Tydfil have prices below £1,000 per square meter. This contrast is stark when you compare it to the nearly £12,000 per square meter in Kensington and Chelsea, whereas Port Talbot’s prices hover around £983.

| Area | Average Price per Square Meter |

|---|---|

| Kensington and Chelsea | £19,439 |

| Barking and Dagenham | £3,994 |

| Elmbridge, Surrey | £6,942 |

| Hackney | £6,942 |

| Blaenau Gwent, South Wales | £777 |

| Port Talbot, Wales | £983 |

London has the most price per square meter expensive areas, with twenty of the top spots. Yet, places like Blaenau Gwent shine for their affordability. These insights into property prices per square meter are invaluable for both buyers and investors navigating the real estate market.

Trends in UK Housing Market

For many years, the UK housing market has been on the rise, especially in top areas like London. Knowing past movements helps us understand house price per square meter current changes and future expectations.

In March 2023, house prices in the UK went up by 4.1% over the year. This was slower than February’s 5.8% increase. The average price price per square meter was £285,000 in March, £11,000 more than the previous year but £8,000 less than in November 2022.

There’s a big difference in house prices across the UK regions. For example, England’s average in March was £304,000 (up 4.1%), while Wales rose by 4.8% to £214,000. Scotland’s prices went up by 3.0% to £185,000, and Northern Ireland saw the biggest jump of 5.0%, reaching £172,000.

Rising mortgage rates are changing UK property market trends. The South West saw a 5.4% jump in March 2023, the most of any region. London’s prices grew the least, by only 1.5%, making its average price the highest at £523,000. Northern Ireland was the most budget-friendly, with an average price of £172,000 in the first quarter of 2023.

Even with economic challenges price per square meter, demand for houses remains firm. Data from March 2023 shows a slight rise in house sales. The UK saw about 89,560 home sales that month, 18.9% less than the year before but 1.3% more than February 2023.

Experts like Savills and Knight Frank feel cautiously hopeful about UK house prices, predicting a 4% rise by 2025. However, buying a home could still be hard for many people. Also, despite no big sales spike after budget and rate changes, agreed sales and new sellers have gone up this year.

| Region | March 2023 Average Price | Annual Change |

|---|---|---|

| England | £304,000 | 4.1% |

| Wales | £214,000 | 4.8% |

| Scotland | £185,000 | 3.0% |

| Northern Ireland | £172,000 | 5.0% |

Factors Influencing House Prices in the UK

Many things impact the cost of homes in the UK. Supply and demand play a huge part. If there are more homes than buyers, prices drop. But if there are more buyers than homes, prices go up. Interest rates also matter a lot. When they’re low, loans are cheaper. This makes more people want to buy homes, pushing prices up.

The type of house matters too. Big houses with gardens and garages usually cost more. If a house is in a good area with nice schools and transport, it’s worth more. But if there’s lots of crime or pollution, it’s worth less. These things all mix together to set house prices in the UK.

The state of a house affects its price as well. New houses with the latest comforts and good energy use are more valuable. But price per square meter if there’s something illegal about the house, like a bad extension, it could lower the house’s value. Making a house better, like adding a new kitchen or smart tech, can raise its price. The chance to make the house better in the future also adds value. It’s clear that both the market and the house’s details are important in the UK.